how to pay indiana state withholding tax

You are still liable for any additional taxes due at the end of the tax year. Annual Withholding Tax Form Register and file this tax online via INTIME.

State Tax Rates 2022 What Numbers Determine Your Contributions Marca

Overall an employer is eligible to register for withholding tax if the business has.

. Legend See notes below. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. The supplemental withholding rate is 5.

Pay my tax bill in installments. Please see below the mailing addresses to send your Indiana Form IT-40 Indiana Full-Year Resident Individual Income Tax Return. If your small business has employees working youll need to understand the state law requirements for withholding.

Find Indiana tax forms. This forms part of Indianas state payroll taxes every employee is liable to pay. Does not obligate your employer to withhold the amount.

If no payment is enclosed mail to. Does not obligate your employer to withhold the amount. You may file a new Form WH-4 at any time if the number of exemptions increases.

If the employer does withhold the ad-ditional amount it should be submitted along with the regular state and county tax withholding. For all other tax type registrations please visit our new platform INTIME Well need to ask a few questions about your business to get started. It is charged at a flat rate of 323 and in addition there is a county income tax where every county has its allocated tax rate.

Indiana Department of Revenue. Is the business that you are registering a tax preparation service that will file and pay taxes on behalf of business clients. Now you can easily create a Form W-4 that reflects your planned tax withholding amount.

50-State Guide to Income Tax Withholding Requirements Everything you need to know about income tax withholding in any state. You are still liable for any additional taxes due at the end of the tax year. State Charities Regulation State Tax Filings State Filing Requirements for Political Organizations Indiana Internal Revenue Service.

43-1011Under SB 1828 and effective January 1 2022 the law createsa two-tier individual income tax rate structure of 255 and 298 depending on filing status and taxable income. Claim a gambling loss on my Indiana return. Indiana state filing information for tax-exempt organizations.

SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of federal state and local permits licenses and registrations youll need to run a business. If you are enclosing a payment mail to. Underpayment of Indiana Withholding Filing Register and file this tax online via INTIME.

2021 2022 Paycheck and W-4 Check Calculator. Know when I will receive my tax refund. Indiana Withholding Tax Voucher Register and file this tax online via INTIME.

Withholding Tax Tables and Instructions for Employers and Withholding Agents p. The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4 calculator tool for you. Take the renters deduction.

Small Business Administration - Indiana State Agency List Indiana Small Business Development Center Department of Administration - Procurement Division myLocalINgov. Indiana Department of Revenue. You may file a new Form WH-4 at any time if the number of exemptions increases.

State Form Number Description File Type. If the employer does withhold the ad-ditional amount it should be submitted along with the regular state and county tax withholding. Have more time to file my taxes and I think I will owe the Department.

State W 4 Form Detailed Withholding Forms By State Chart

How Do State And Local Sales Taxes Work Tax Policy Center

How Do State And Local Individual Income Taxes Work Tax Policy Center

State W 4 Form Detailed Withholding Forms By State Chart

State Corporate Income Tax Rates And Brackets Tax Foundation

A Basic Overview Of Indiana S Wh 4 Form For State Tax Withholding

Do I Have To File State Taxes H R Block

16 Printable Indiana State Tax Withholding Form Templates Fillable Samples In Pdf Word To Download Pdffiller

Dor Make Estimated Tax Payments Electronically

How Do State And Local Sales Taxes Work Tax Policy Center

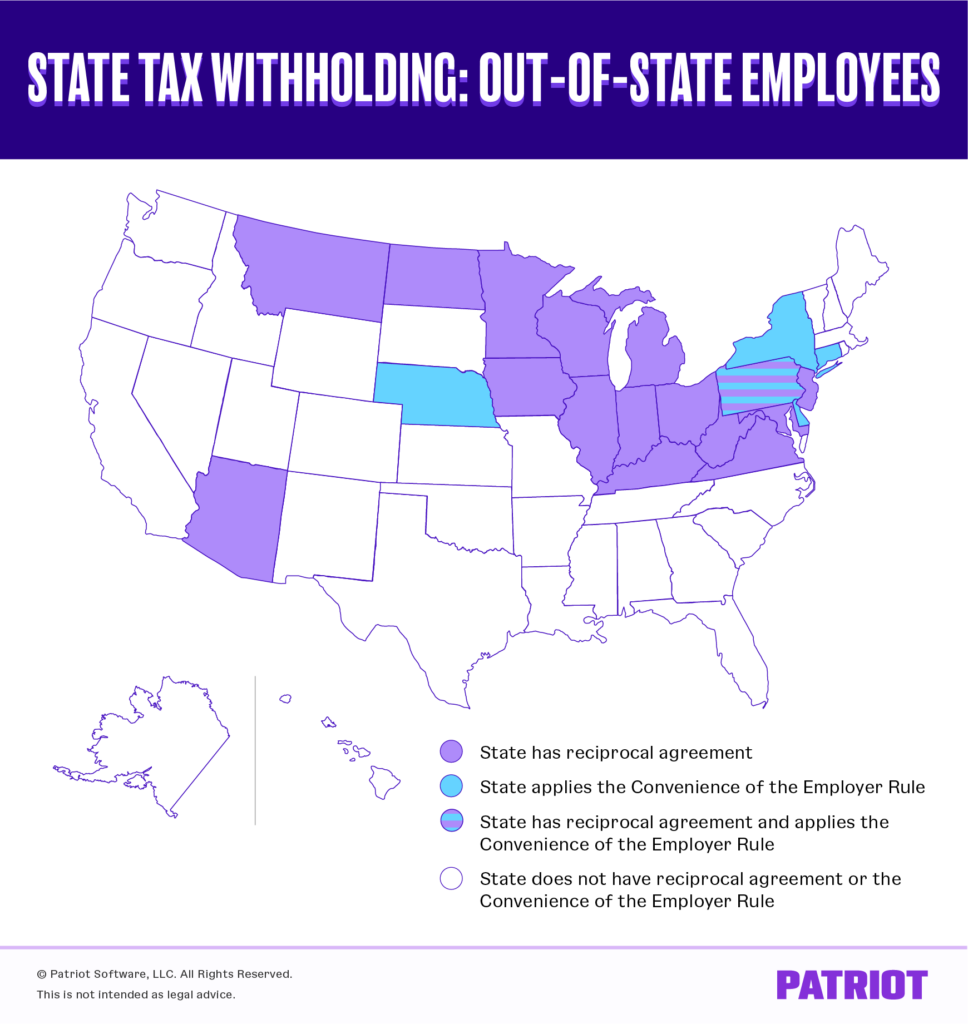

State Tax Withholding For Remote Employees

How We Got Here From There A Chronology Of Indiana Property Tax Laws

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

Dor Owe State Taxes Here Are Your Payment Options